Business Insurance in and around Lake Charles

Calling all small business owners of Lake Charles!

Helping insure businesses can be the neighborly thing to do

This Coverage Is Worth It.

Operating your small business takes time, creativity, and excellent insurance. That's why State Farm offers coverage options like a surety or fidelity bond, business continuity plans, errors and omissions liability, and more!

Calling all small business owners of Lake Charles!

Helping insure businesses can be the neighborly thing to do

Protect Your Future With State Farm

Whether you own a floral shop, an antique store or a barber shop, State Farm is here to help. Aside from excellent service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

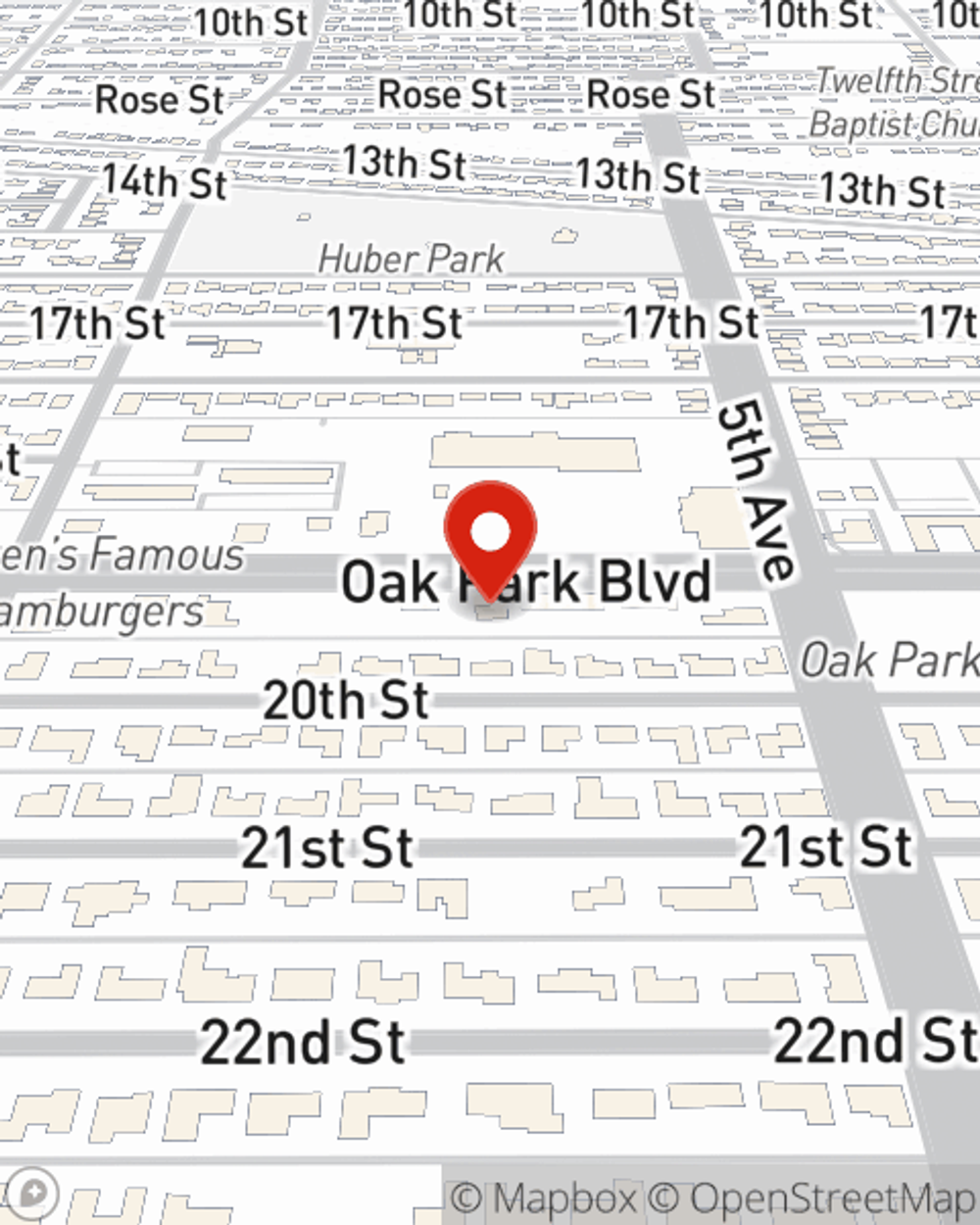

Agent Blaine Newby is here to review your business insurance options with you. Contact Blaine Newby today!

Simple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Blaine Newby

State Farm® Insurance AgentSimple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.